To assess team performance ahead of UEFA Women’s EURO 2025, Kitman Labs’ Data Science team developed a statistical simulation framework using the latest official FIFA Women’s World Ranking points. This model calculates the probability of each team winning, drawing, or losing any given match within the tournament.

To forecast outcomes across the entire competition, we ran 10,000 full-tournament simulations, with every match played out based on those calculated probabilities. This allows us to determine how frequently each nation advances to the quarterfinals, semifinals, and final, and how often they ultimately win the championship.

The results—stage-reach probabilities and full finish distributions—represent a comprehensive and data-grounded forecast generated through this simulation process.

While not a deterministic forecast, these simulation-based probabilities offer a structured, data-driven lens to evaluate tournament pathways, competitive strength, and risk. Below, we analyze the five top contenders.

Spain: Highest Pre-Tournament Rating and Most Cohesive Squad

Stage Probabilities

Champion 24.0%| Final: 38.1% | Semifinal: 64.7% | Quarterfinal: 82.2%

Strategic Snapshot

Pros

- Highest FIFA pre-tournament rating

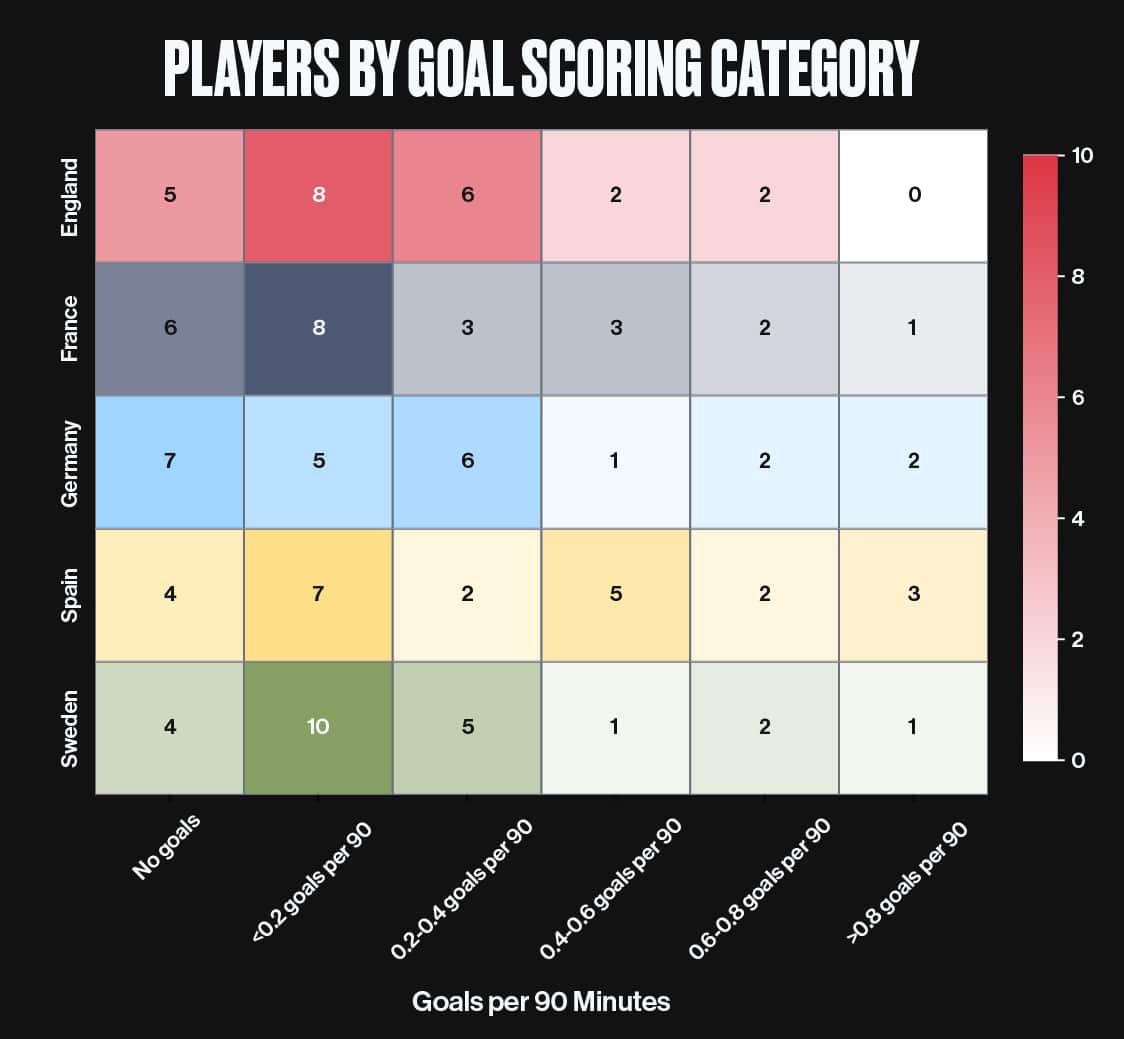

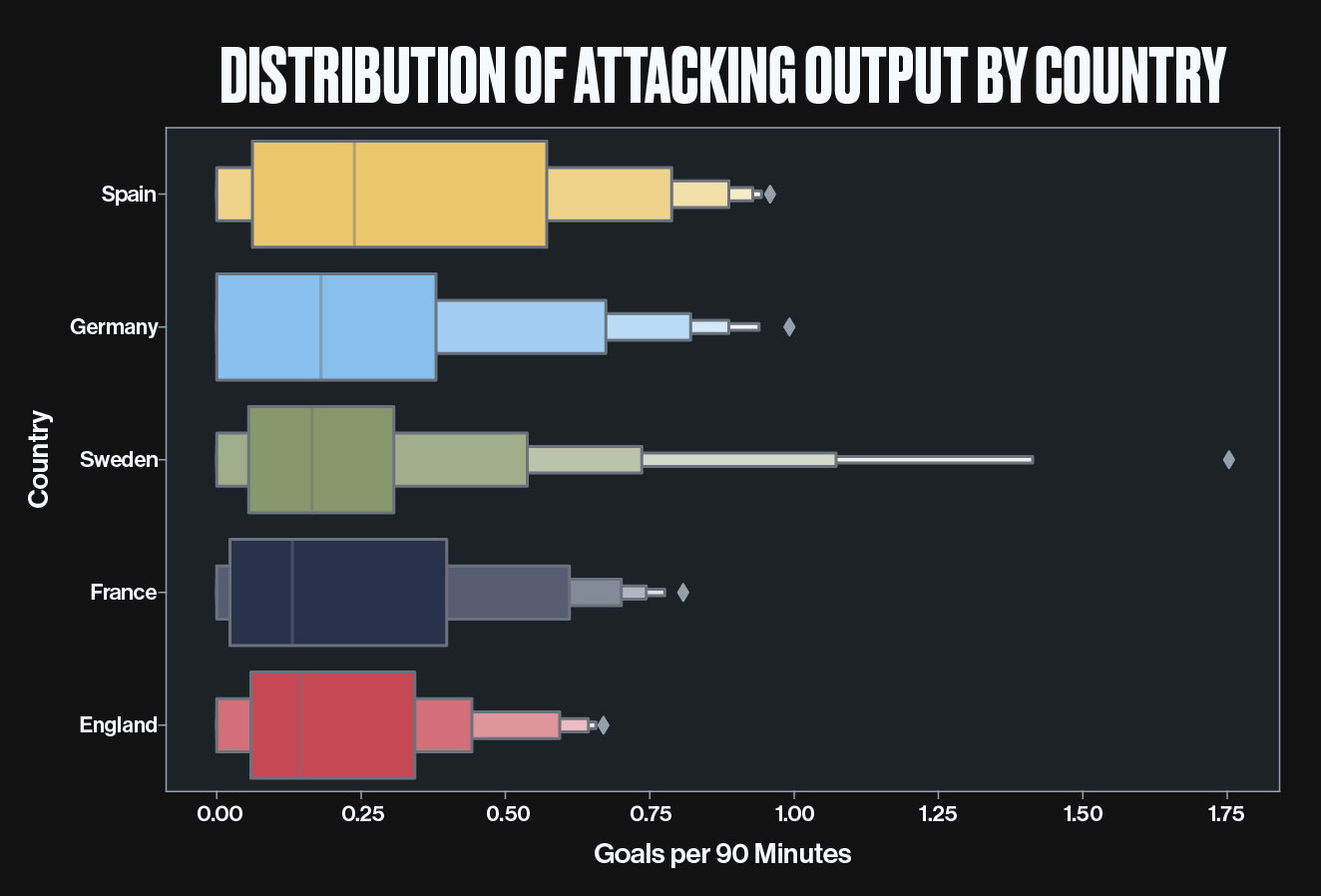

- Most high-output attackers (10 players > 0.4 goals/90)

- Strong squad cohesion (9 players from Barcelona)

Cons

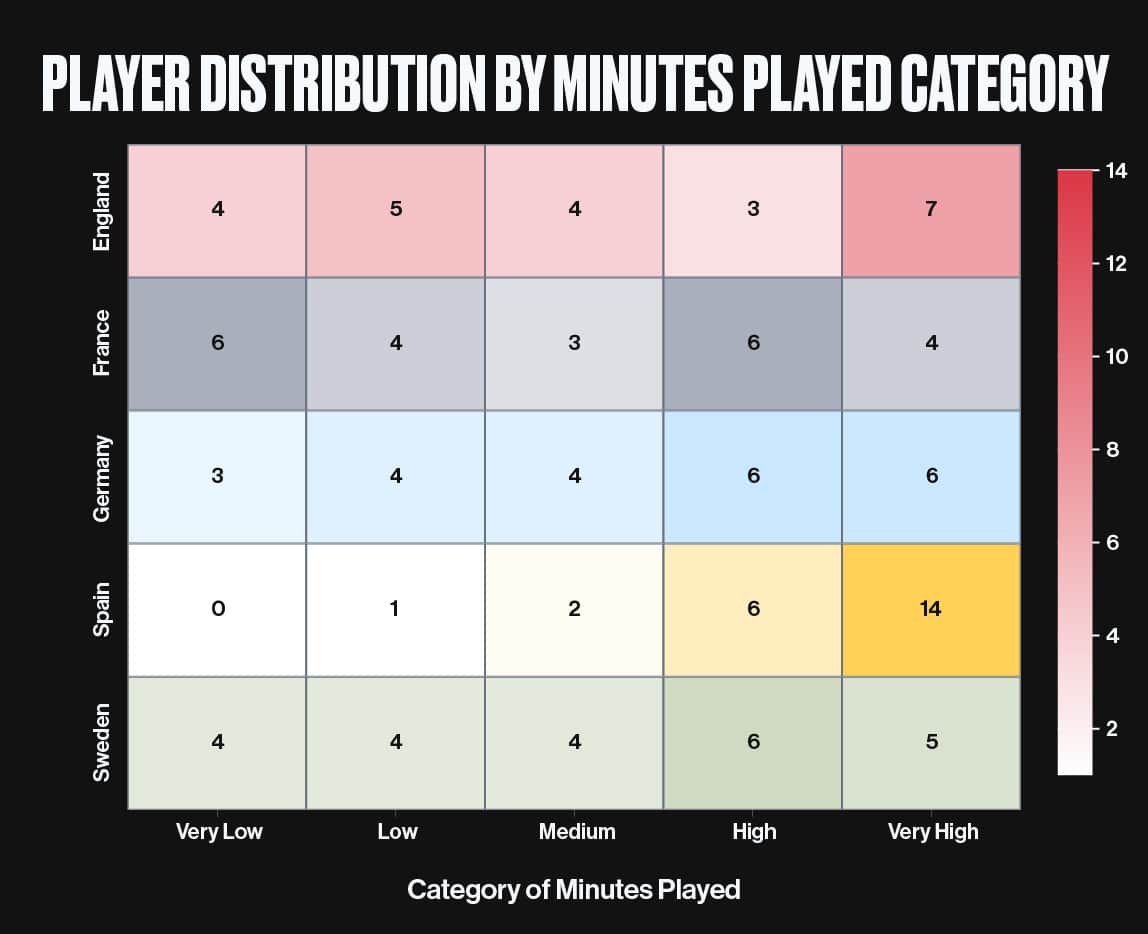

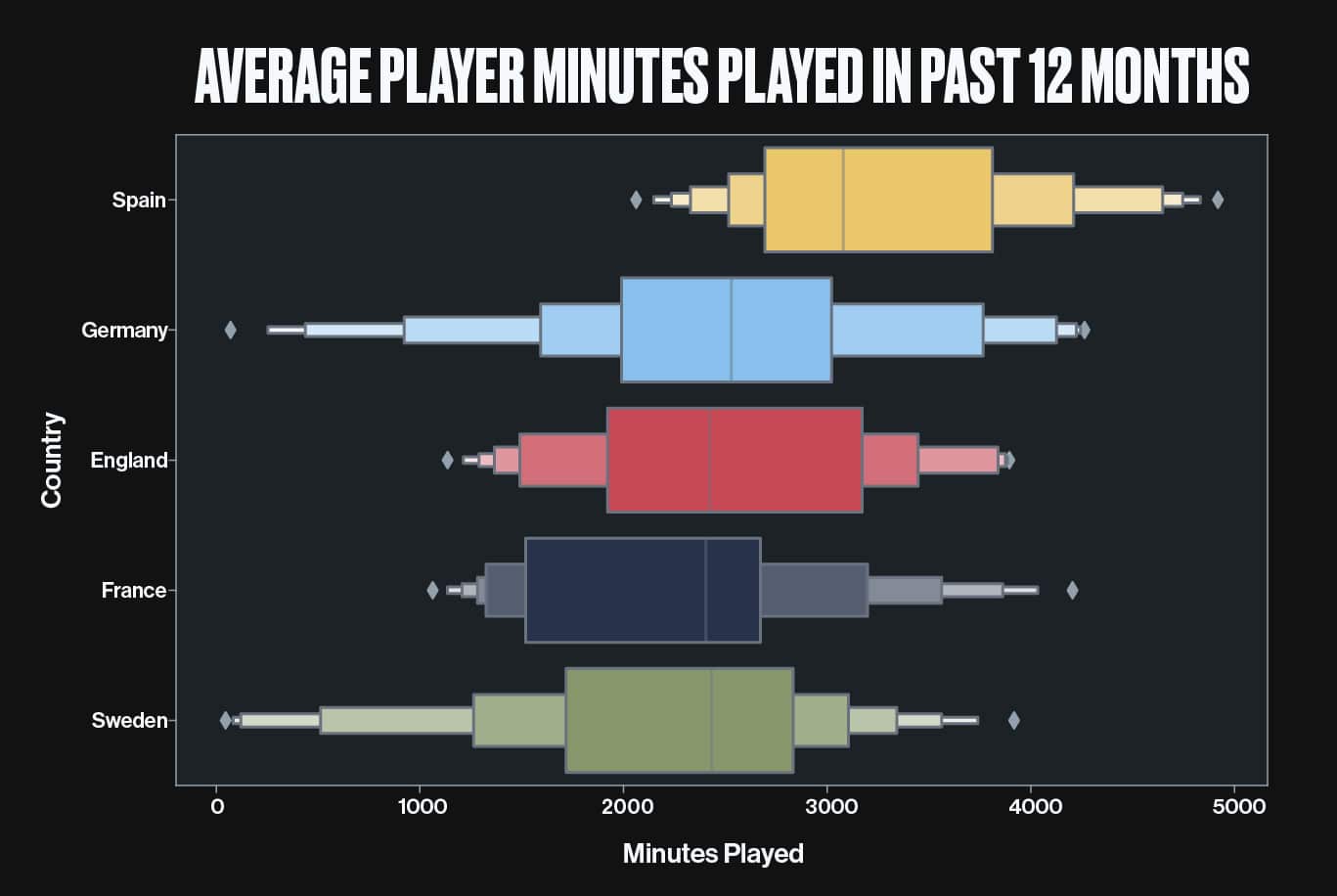

- 14 players with high match minutes

- A compressed schedule may amplify fatigue risk

Spain enters UEFA Women’s EURO 2025 with the highest pre-tournament FIFA ranking and a strong run of form, winning seven of their last eight matches. While the team has fallen short in previous European competitions, current metrics and squad performance suggest they are well-positioned to contend.

Their attacking profile is particularly strong: ten players have averaged more than 0.4 goals per 90 minutes in the past year, the highest among all contenders, with France the next closest at six.

A major structural advantage lies in squad cohesion. Nine players come from the same club—Barcelona—providing a foundation of tactical familiarity and built-in chemistry that few others can match.

However, this cohesion may come with a physical cost. Fourteen players fall into the “very high minutes played” category over the past 12 months. For many—especially those who competed in the Olympics and had shortened offseasons—cumulative fatigue could become a risk during the latter stages of the tournament.

Germany: High Output and Club Cohesion Offset by Injury Risk

Stage Probabilities

Champion: 19.0% | Final: 31.5% | Semifinal: 46.4% | Quarterfinal: 74.8%

Strategic Snapshot

Pros

- Strong historical record (8-time EURO champions)

- Second-highest attacking output (goals per 90) among favorites

- High club continuity (2.5 players per club team, mainly from Bayern Munich and Wolfsburg)

Cons

- Several players with lower match minutes in past 12 months

- Recent injuries to key midfielders may affect readiness

Germany enters UEFA Women’s EURO 2025 with both pedigree and production. An eight-time European champion, the squad is also coming off a bronze medal at the 2024 Olympics. Their offensive output ranks second among the five favorites, with several players averaging high goals per 90 minutes over the past year.

Another notable advantage is club continuity. Germany averages 2.5 players per club team, with a strong core from Bayern Munich and Wolfsburg, providing built-in tactical familiarity and shared systems of play.

However, player readiness remains a question. Germany’s minutes-played profile over the past 12 months includes several squad members with limited exposure, which may impact the team’s rhythm and match sharpness. Midfielder Lena Oberdorf has been ruled out due to an ACL injury sustained in Euro qualification. Sara Däbritz, who missed the 2024 Olympics with an ankle injury, has returned to fitness but enters the tournament with fewer minutes than usual.

That said, lower cumulative minutes could also indicate greater freshness—a potential benefit in a compact, high-intensity tournament.

England: Lower Probabilities Driven by Group Difficulty and Squad Turnover

Stage Probabilities

Champion: 13.9% | Final: 24.9% | Semifinal: 39.5% | Quarterfinal: 71.2%

Strategic Snapshot

Pros

- Second-highest average player market value

Strong baseline of individual talent - The recent WSL Golden Boot winner in attack

Cons

- Difficult path (Group C + likely Germany/Sweden QF matchup)

- Key veteran departures (Earps, Kirby, Bright)

- No striker in elite goals-per-90 category (>0.8)

England enters UEFA Women’s EURO 2025 facing both structural and form-based challenges. Group C is projected to be one of the toughest in the tournament, and even a first-place finish likely sets up a quarterfinal clash with Germany or Sweden. Adding to this, England is winless in their last four matches and hasn’t recorded a victory outside of England in over a year.

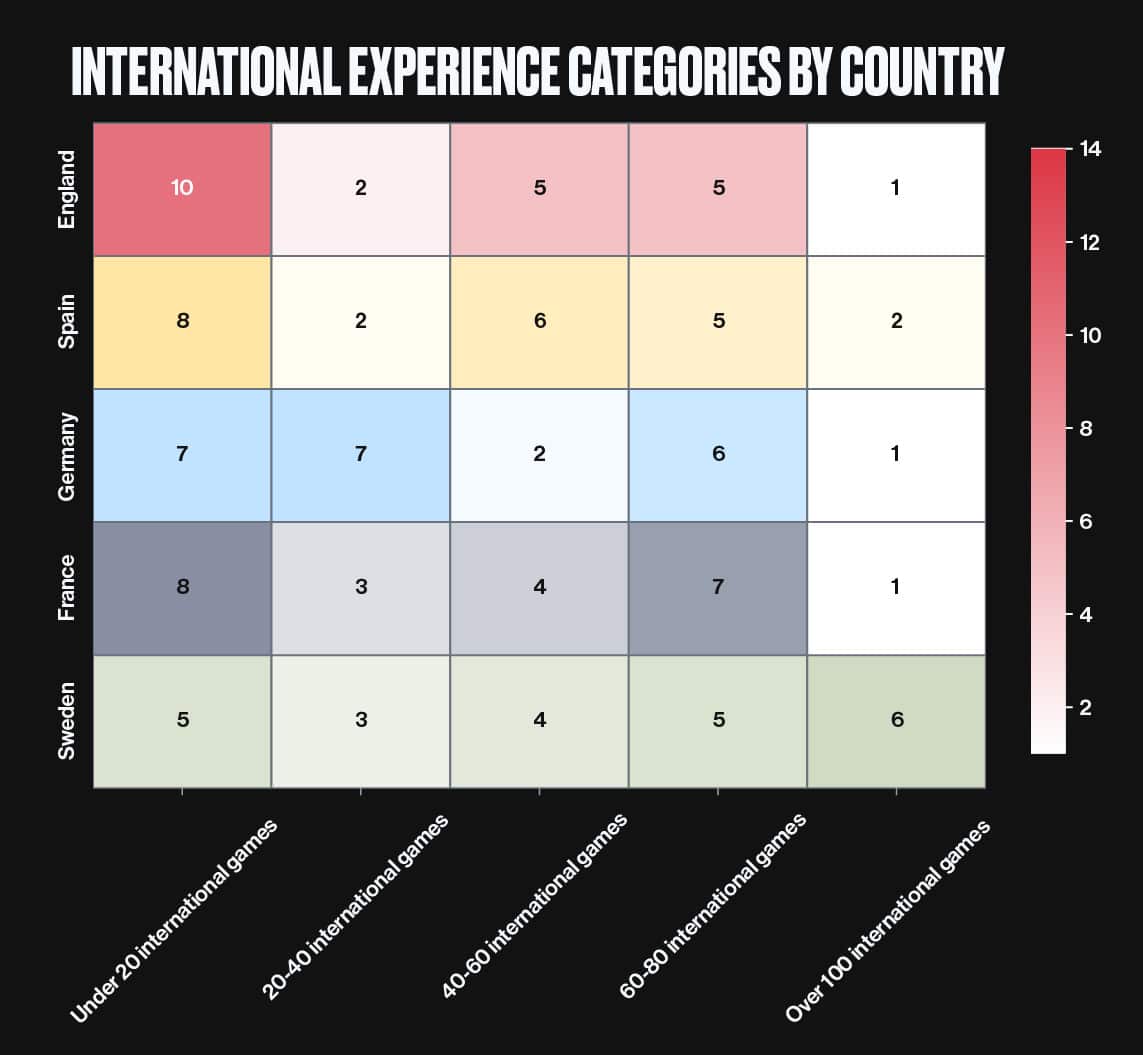

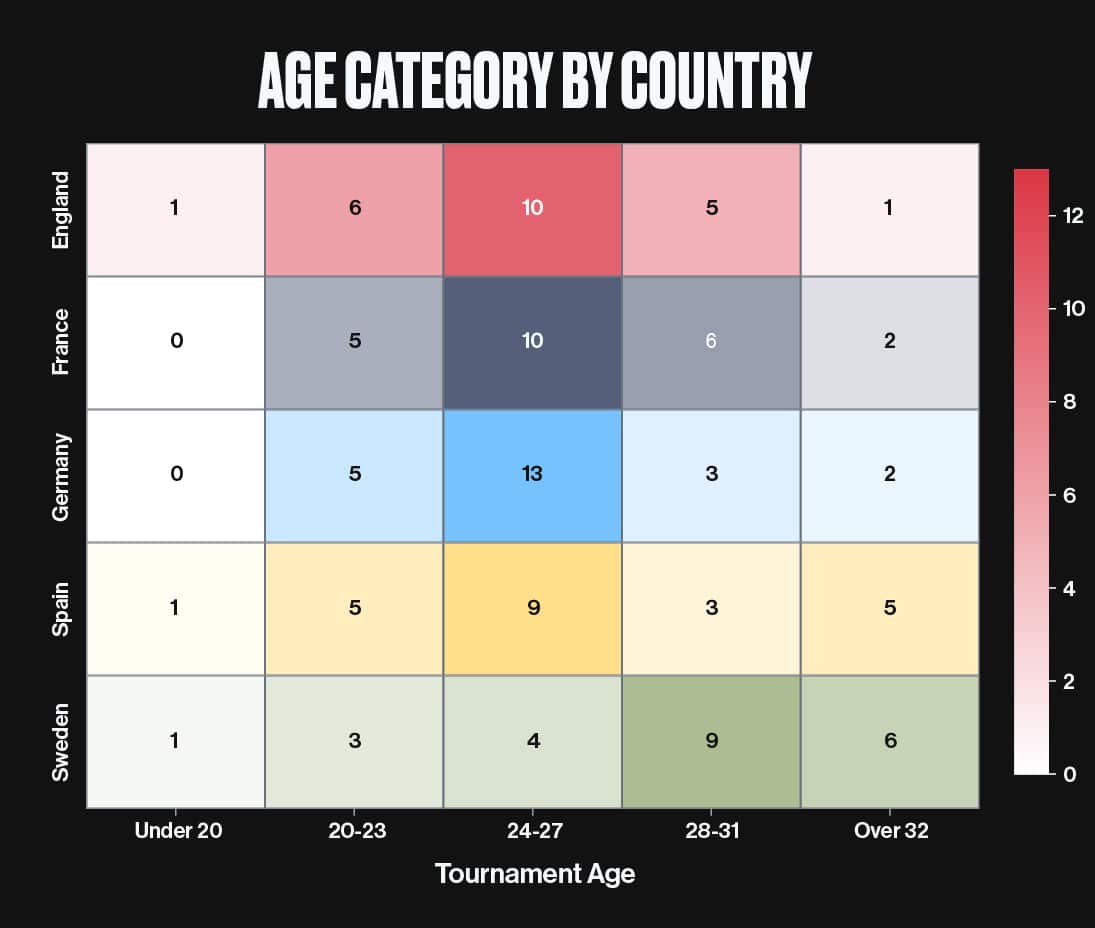

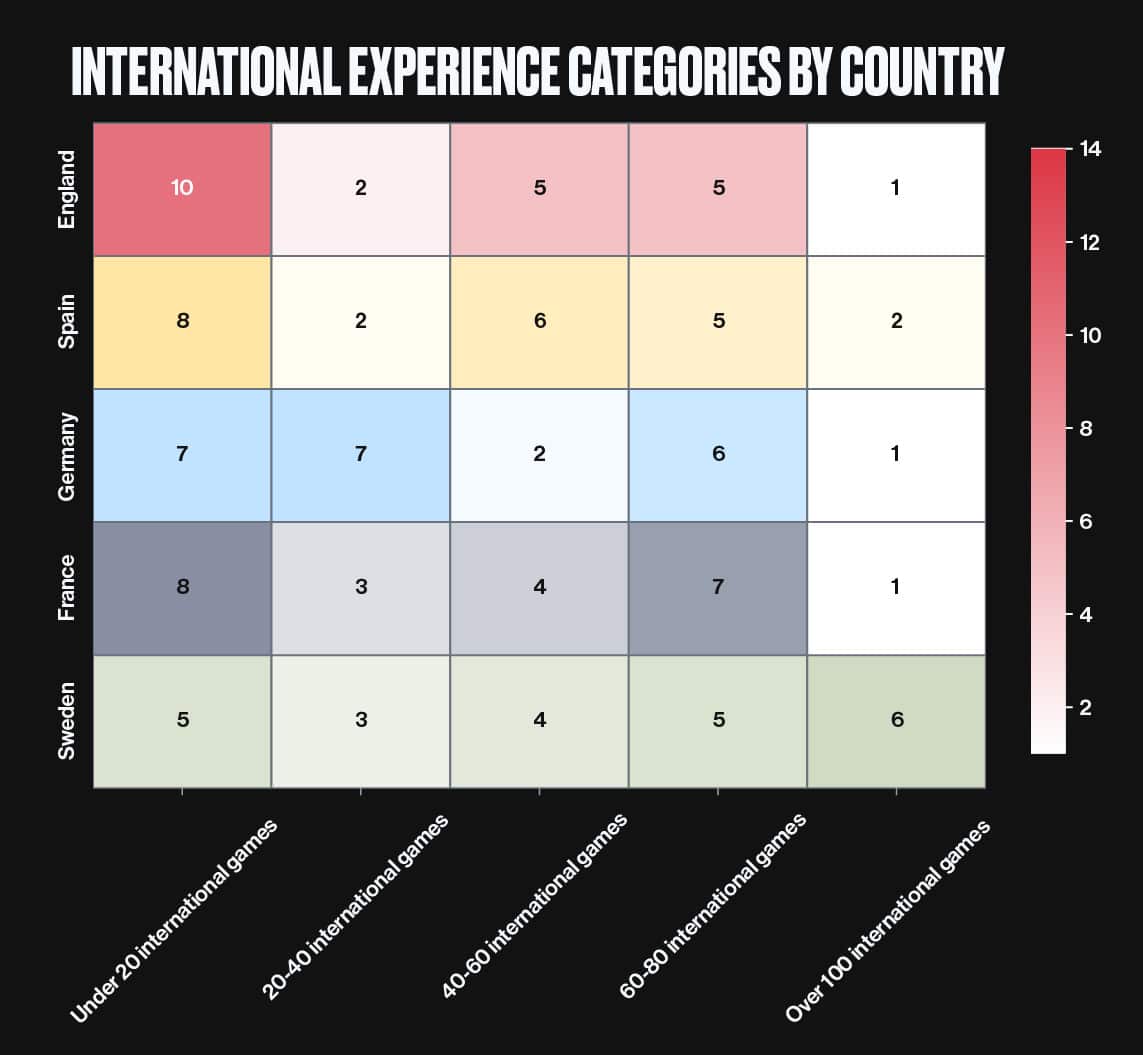

Recent squad turnover may also affect continuity. Longstanding leaders Mary Earps and Fran Kirby have retired, while Millie Bright has withdrawn due to injury. Their replacements bring significantly less international experience, which could influence performance under pressure.

While this may reflect the competitiveness of the domestic leagues their strikers compete in, it also suggests the absence of a consistently high-volume scorer. Even Alessia Russo, this year’s WSL Golden Boot winner with 12 goals in 22 matches, falls just short of the top threshold when adjusted per 90 minutes.

Notably, England’s players carry one of the highest average market values among the top five nations, second only to Spain. This valuation points to a strong foundation of individual quality, even if recent collective performance has yet to reflect that upside.

Sweden: Experienced Squad Facing Compressed Schedule Demands

Stage Probabilities

Champion: 12.4% | Final: 23.5% | Semifinal: 37.6% | Quarterfinal: 67.1%

Strategic Snapshot

Pros

- Strong track record in major tournaments

- Six players with 100+ international caps

- Fewest players with <20 caps among the favorites

Cons

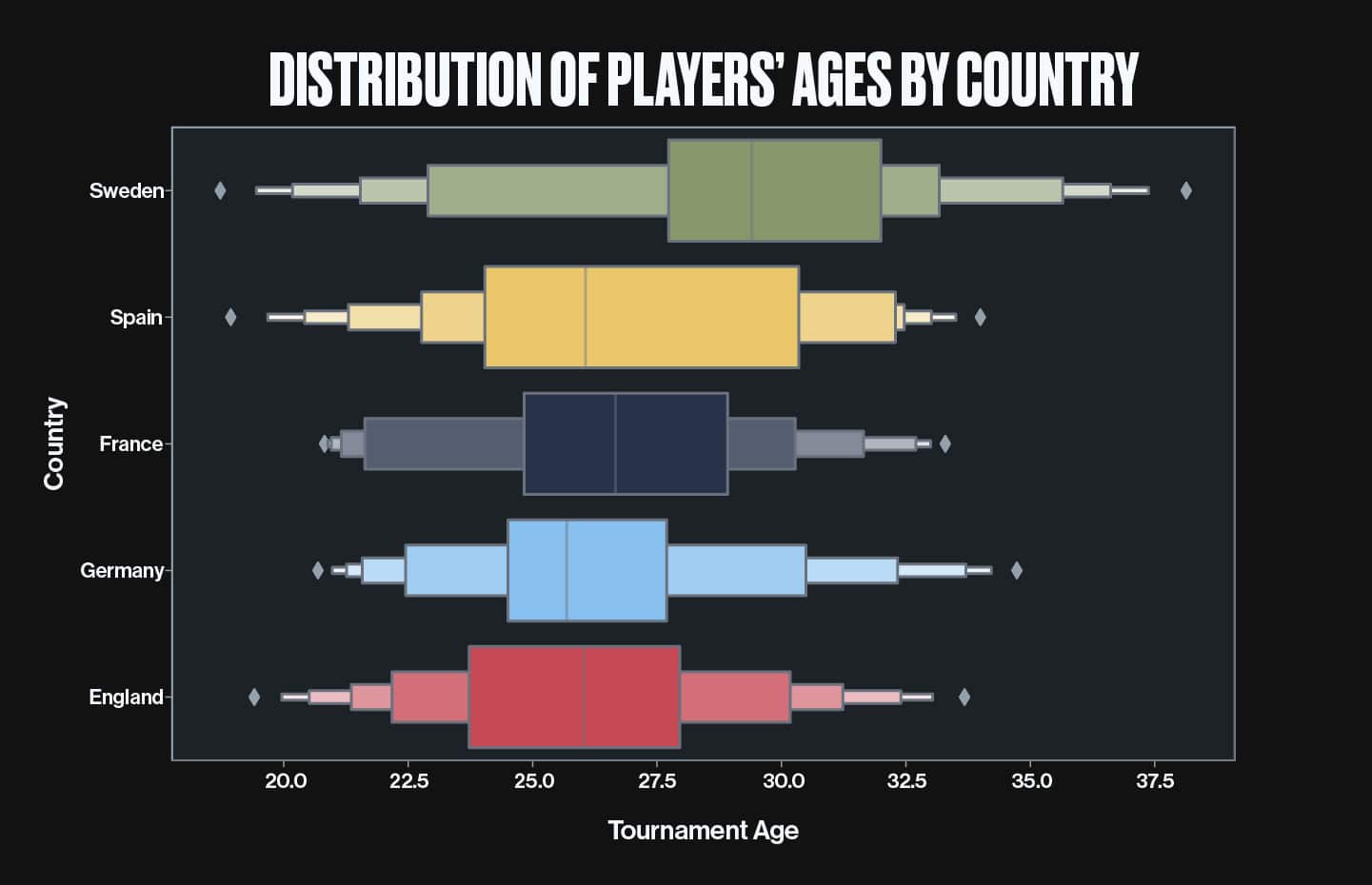

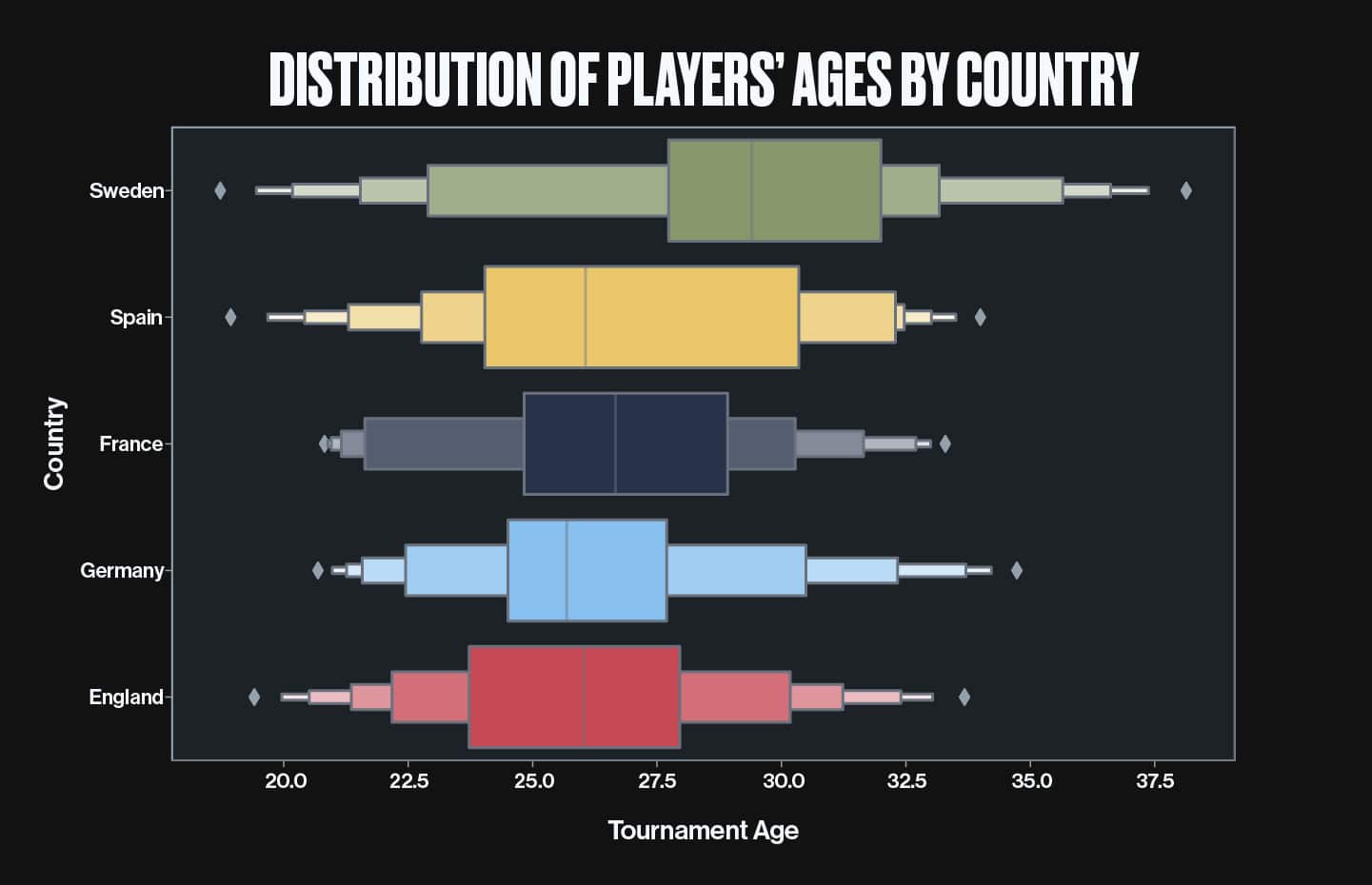

- Oldest average squad age among top contenders

- The tournament’s compressed schedule may strain recovery

Sweden arrives at UEFA Women’s EURO 2025 with a legacy of reliability and resilience. The team has reached the top four in several major tournaments over the last decade and has never failed to progress past the group stage in European Championship history. Their experience and cohesion are cornerstones of their identity.

However, age may also present a risk. Sweden fields the oldest squad among the five favorites. With seven matches played over just 25 days, the physical toll of a condensed schedule could be more pronounced for veteran players, especially in later knockout rounds.

That said, this aging core also brings unmatched leadership. Six players boast over 100 international caps, and just five have fewer than 20—a level of international experience unmatched by any other favorite. This balance of familiarity, composure, and tactical maturity could be a decisive asset in high-pressure moments.

France: Balanced Age Profile, but Key Veteran Omissions Raise Questions

Stage Probabilities

Champion: 7.4% | Final: 15.8% | Semifinal: 27.9% | Quarterfinal: 59.7%

Strategic Snapshot

Pros

- Strong prime-age core (24–28)

- Most players have 50–80 international caps

- Clara Matéo offers elite scoring form

Cons

- Lowest FIFA ranking among the five favorites

- Exclusion of two key veterans may impact leadership

France enters UEFA Women’s EURO 2025 as the lowest-rated team among the top five based on FIFA points, but their internal structure tells a more nuanced story. The squad is well-balanced in age, with a concentration of players in their physical prime (24–28 years old), and most have between 50–80 international caps, offering a mix of youth, maturity, and match experience.

One player to watch is Clara Matéo, who topped the scoring charts in the French Première League this season. She brings momentum and attacking output that could help fill the gap left by more senior players.

That gap is significant. France made the surprising decision to leave out longtime captain Wendie Renard (168 caps) and all-time leading scorer Eugénie Le Sommer. Their absence removes two of the most seasoned leaders in the game. Whether this signals a bold new era—or a strategic misstep—remains one of the tournament’s biggest questions.

Model Scope and Limitations

The model does not account for dynamic variables like form, injuries, or momentum. It is based solely on static FIFA ranking points and does not reflect real-time developments or psychological performance factors.

Additionally, the model doesn’t incorporate individual player availability (e.g., injuries or suspensions) or “clutch” factors such as pressure resilience or team momentum during the tournament. These elements can significantly influence real-world outcomes.

Conclusion

Simulation modeling can help contextualize tournament probabilities and spotlight performance patterns. While not exhaustive, this analysis offers an evidence-based perspective to guide expectations and track variance as the competition unfolds.

The matches may defy the data, but the data offers a powerful baseline.

Looking to run your forecasting models or performance simulations? Kitman Labs’ Custom Analytics team partners with sports organizations to deliver bespoke projects, ranging from injury risk profiling to full-tournament simulation modeling.